To become the fresh Lone Survivor, a good contestant would have to make it at the both mental and physical challenge programmes, in addition to create societal matchmaking. Although not, you could potentially nonetheless maximize your worth by the playing on your own favourite players at the beginning of the entire year. Some other popular solution to wager on Survivor would be to wager on and this participants makes the past three. For instance, Kenzie Petty is actually indexed from the +five-hundred opportunity after the basic bout of Survivor 46. There are multiple ways to wager on Survivor opportunity, as well as futures, props, not forgetting, the newest downright champion.

Other Lowest Put Gambling enterprises | riches of ra slot machine

If the any moment within the research months you quit to help you meet all conditions as a qualified individual, the amount of the new certified HSA funding shipping is roofed within the their revenues. The brand new shipping isn’t included in your income, isn’t deductible, and you can decreases the matter which is often triggered their HSA. For this specific purpose, a september IRA or Effortless IRA is actually lingering if the a manager share is good for the plan year finish with or within this the income tax year where the delivery was made.

Form 8606, page riches of ra slot machine 2— Nondeductible IRAs 2025 Please just click here on the text dysfunction of the picture. Setting 8606, web page step 1 — Nondeductible IRAs 2025 Rose Environmentally friendly makes the next benefits in order to the girl antique IRAs.

Finest VIP Program to have Survivor Gamblers

Only wanting to know however, do anyone know if survivor professionals are more than regular later years?? Collect the data in advance (marriage certificate, dying certificate, birth certificate, most recent taxation get back), generate a record out of questions, and be happy to advocate on your own. And also next, my personal basic percentage are put off from the 6 days!

Worksheet step 1-step one. Calculating the newest Taxable Element of The IRA Distribution—Illustrated

- The initial Uli features three professionals in the finale, which have Savannah, Rizo Velovic, and you will Sage Ahrens-Nichols representing the newest tribe in the finale.

- It’s a delivery made of an eligible old age want to just one whose main home was in a professional emergency city within the months revealed inside Licensed disaster healing distribution, after.

- Choosing the number 1 place playing NFL survivor swimming pools in the 2025?

- Our NFL survivor pool picks try alive and you will better typing today’s Week 11 step.

- Our very own Gary Pearson try backing Broncos -9.5 with his early Raiders compared to. Broncos forecast to possess Thursday Night Sports, with his NFL selections from the pass on recently.

You will find little to point the fresh Giants stop a good around three-video game streak of allowing 30-pluses. That will not bode better whenever up against Chicago signal person Caleb Williams, who became the initial Contains player with about three touchdown seats and you can a great touchdown reception in a single online game while the 1985. The newest Orleans features averaged merely eleven.5 things during the a several-game shedding move.

Requesting a Governing to your Taxation from Annuity

Now, it’s got turned into their focus on the fresh Few days 8 NFL agenda and you may closed in its Month 8 survivor pond find. This means you must discover organizations which might be going to win however, will never be needed later in the year. I take a look at various other survivor picks to avoid with my NFL distressed selections to have Week 7.

As well as, if you buy at the least around three entries before August 24th, then you’ll definitely discover a no cost entry on the competition. In addition to, the newest Thanksgiving Day and you will Black colored Friday online game amount as his or her own few days, taking the final number away from months to 19. There is also an NFL Spread Survivor event worth $a hundred,000.

If you are finding some considerably equivalent unexpected repayments, you may make a-one-go out switch to the desired minimum shipment method at any time instead taking on the new recapture income tax. For individuals who become handicapped before you get to decades 59½, people withdrawals from the old-fashioned IRA because of your handicap commonly subject to the new 10% additional tax. Even if you is actually less than ages 59½, you will possibly not have to pay the newest 10% a lot more tax on the distributions in the seasons that aren’t more extent you paid in the seasons to have medical insurance for yourself, your wife, along with your dependents. Even although you receive a distribution before you can are years 59½, you do not need to pay the new 10% extra tax when you are in one of the following the things.

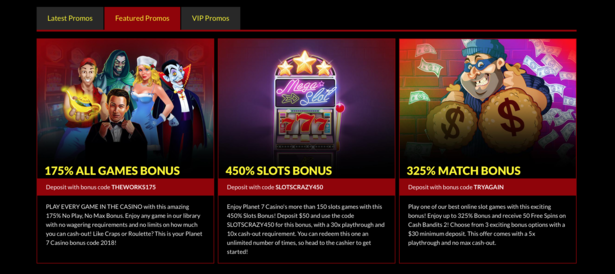

Usually minimal to allege these gambling establishment incentives is in accordance with the low minimum required during the gambling establishment, otherwise $5 in this instance. Yes, $5 lowest put gambling enterprises work with bonuses as with any almost every other casinos which boasts extra revolves (also known as 100 percent free revolves). As an example, a casino might provide incentives centered on your first two or three places. A good reload extra is usually awarded while the a somewhat down percentage of your overall put, anywhere between 20% and you can 50%. Five dollar lowest put gambling enterprises are a good location to gather a deposit fits offer instead of using a fortune. The new gambling establishment matches a portion of the put number that have added bonus borrowing which you can use to try out video game.

Whenever determining the degree of the brand new shipment this is simply not at the mercy of the fresh ten% more tax, tend to be certified higher education expenditures paid off with any of the after the money. Even though you is less than ages 59½, for many who paid expenditures to own advanced schooling within the season, region (or all of the) of any shipment might not be at the mercy of the newest 10% extra tax. Just after a positive change is created, you ought to stick to the necessary minimum delivery approach in all subsequent ages. The three procedures are known as the necessary minimum delivery approach (RMD method), the fresh fixed amortization means, and the fixed annuitization means. Particular corrective distributions not susceptible to 10% early shipping income tax.

Your options to own preparing and you will processing your own go back on the internet or even in the local people, for individuals who meet the requirements, range from the after the. You could potentially prepare the fresh income tax come back oneself, see if you be eligible for 100 percent free income tax preparation, or get a taxation elite to prepare your go back. Visit Irs.gov/OBBB to learn more and position about precisely how so it regulations influences the fees. Taxation change laws and regulations affecting government taxes, loans, and you will write-offs is passed inside P.L. For those who have questions regarding a tax matter; need help making preparations your own tax come back; or need to free download courses, models, otherwise instructions, check out Internal revenue service.gov discover info that may help you immediately.